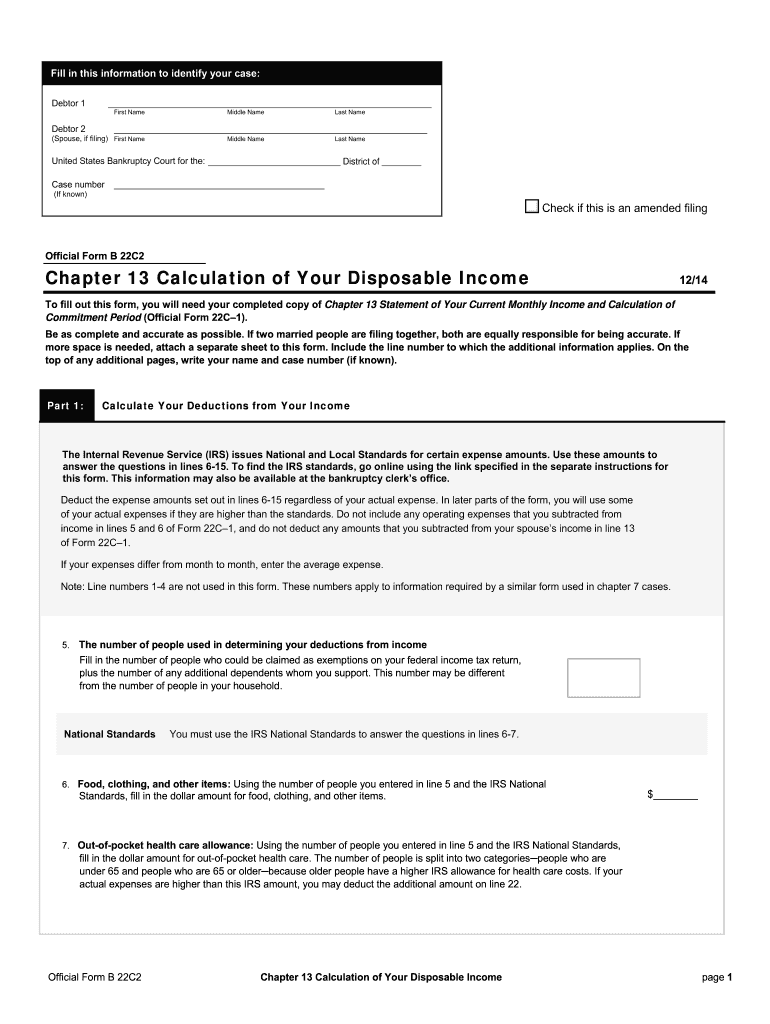

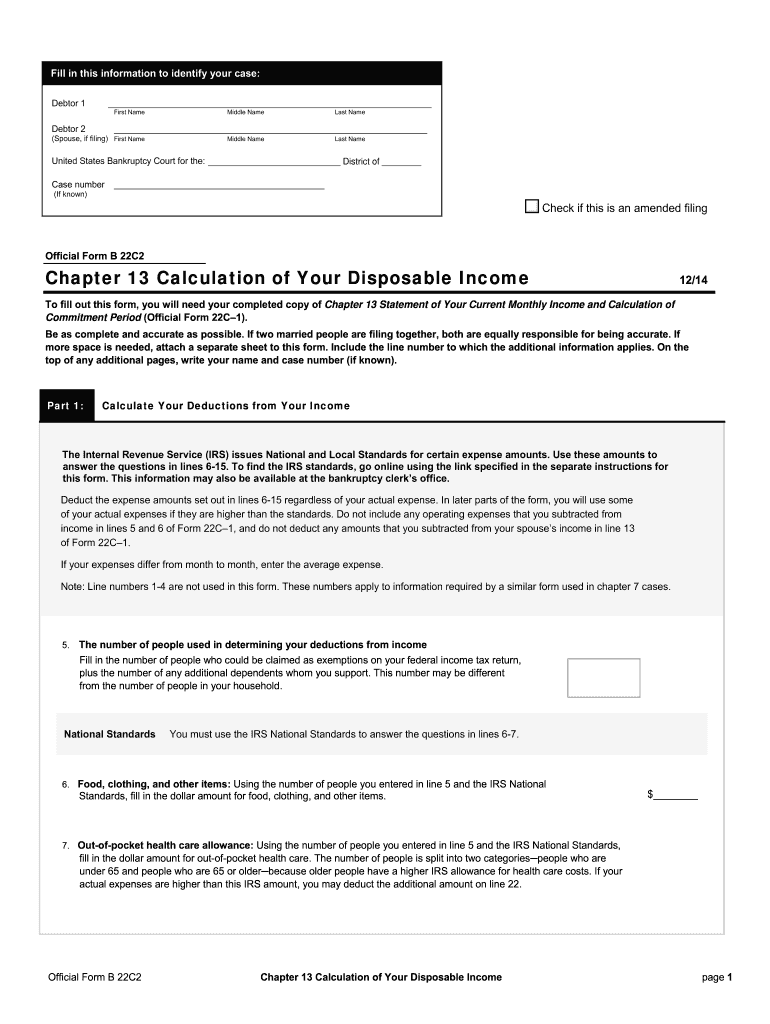

Bankruptcy B 22C2 2014-2024 free printable template

Get, Create, Make and Sign

How to edit calculation disposable online

Video instructions and help with filling out and completing calculation disposable

Instructions and Help about income monthly form

Laws calm legal forms guide this video tutorial will assist you in the process of both accessing and completing form b dash 6 C Schedule C which is the form that lists all property claimed as exempt under your particular bankruptcy filing this particular form is a complement to the other forms you will be filing that will detail your possession of real and personal property as such the filing of the form b dash 6e will require the completion of additional forms with regard to your bankruptcy filing or claim bankruptcy is a legal classification applicable to financial circumstances and situations within which individuals or entities are considered to be financially insoluble this classification implies that the respective debt incurred outweighs the total value of assets and monies in the position of that individual or entity accessing the form b dash 6c Schedule C property claimed as exempt typically you will be required to furnish your form b dash 6 C Schedule C property claimed as exempt in addition to any or all supplemental forms to the Bankruptcy Court applicable to the jurisdiction within which you reside upon contacting your jurisdictional bankruptcy court you can access a Form B dash 6 C Schedule C property claimed as exempt as well as supplemental bankruptcy forms required with regard to your specific circumstance the form b dash 6 C Schedule C property claimed as exempt filing process the form b dash 6 C Schedule C for property claimed as exempt contains only one page the form will first ask for your name and your case number following the input of this basic information you will be required to enter the type of exemptions that you are entitled to either under 11 USC 522 be 2 or 11 USC 522 be three you may also check in the space provided if you claim a homestead exemption that exceeds 146 thousand four hundred fifty dollars the petition consists of four columns and each column will ask for information regarding your exempt property the first column will ask for a brief description of your exempt property the second column will ask you to cite the specific law to warrant exemption the third column will ask for the value of your claimed exemption and lastly the fourth column will ask for the current value of the property minus any deductions for exemption to watch more videos please make sure to visit laws calm

Fill irs download : Try Risk Free

People Also Ask about calculation disposable

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your calculation disposable form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.